Effective Forex Trading Strategies A Comprehensive Guide in PDF 1854317954

In the world of Forex trading, having a well-structured strategy is crucial for success. The dynamic nature of currency markets demands not only intuition but also disciplined planning and execution. To help traders navigate this complex environment, we present an extensive collection of efficient Forex trading strategies in PDF format. This guide is packed with valuable insights and practical tips that can be adapted to various trading styles. For those looking to start trading, consider exploring forex trading strategies pdf Trading Brokers in Morocco for reliable partnership options.

Understanding Forex Trading Strategies

Forex trading strategies are systematic approaches to the trading process. They include a series of rules that govern how one enters and exits trades based on their analysis of price movements and market conditions. These strategies are instrumental in deciding when to buy or sell a currency pair, how much to trade, and when to take profits or losses. A robust strategy aims to maximize profits while minimizing risks.

Types of Forex Trading Strategies

There are several types of Forex trading strategies that traders utilize to achieve their trading goals. Below are some of the most effective strategies:

1. Scalping

Scalping is a short-term trading strategy that involves making a large number of small profits on minor price changes throughout the day. Scalpers aim to capture small price movements within a very short period, often holding positions for just a few minutes. This strategy requires a keen eye on market movements and high trading volumes.

2. Day Trading

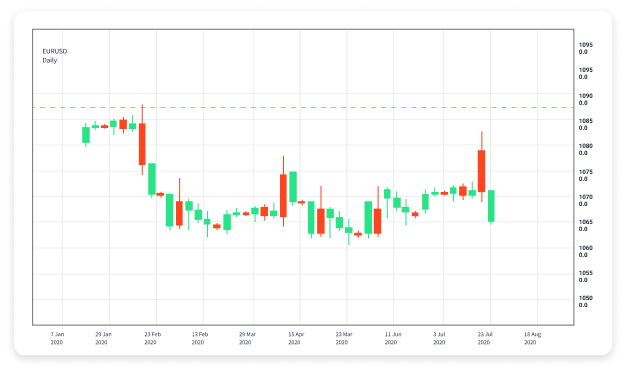

Day trading involves opening and closing trades within the same trading day. Traders who use this strategy do not leave positions open overnight to avoid exposure to market risk due to unforeseen events. Successful day traders employ technical analysis, chart patterns, and indicators to make informed decisions.

3. Swing Trading

Swing trading is a medium-term strategy where traders hold positions for several days to take advantage of price swings in the market. This approach requires a deeper understanding of market trends and often involves using both technical and fundamental analysis to identify potential entry and exit points.

4. Position Trading

Position trading is a long-term strategy that involves holding onto trades for weeks or even months. Position traders rely heavily on fundamental analysis and macroeconomic factors, looking for currencies that are undervalued or overvalued based on economic indicators.

5. Algorithmic Trading

Algorithmic trading uses computer programs to execute trades based on pre-defined criteria. This strategy can analyze multiple variables and market conditions more quickly than a human trader, making it suitable for high-frequency trading environments.

Key Components of a Forex Trading Strategy

A successful Forex trading strategy should incorporate several key components:

1. Risk Management

Effective risk management is crucial for longevity in trading. Traders should establish clear guidelines on how much capital they are willing to risk on a single trade, utilizing stop-loss orders to limit potential losses.

2. Analyzing Market Conditions

Understanding market dynamics, including economic indicators, geopolitical events, and currency correlations, can significantly impact trading success. Traders should stay informed about the latest news and reports affecting the currencies they trade.

3. Technical Analysis

Most trading strategies heavily rely on technical analysis. This includes using charts, indicators, and price patterns to predict future price movements. Common tools include moving averages, RSI, MACD, and Fibonacci retracement levels.

4. Trade Journals

Keeping a trade journal is vital for analyzing performance over time. Traders should document their trades, including entry and exit points, the rationale behind each trade, and the psychological factors that affected their decisions.

Developing Your Forex Trading Strategy

Creating a personalized Forex trading strategy involves several steps:

1. Define Your Goals

Before creating a strategy, traders must define their goals. Are they looking for quick profits, or are they interested in long-term investments? Your goal will shape the structure of your strategy.

2. Choose a Trading Style

Select a trading style that aligns with your personality and lifestyle. Some traders thrive in fast-paced environments, while others prefer a more measured approach.

3. Test Your Strategy

Before trading with real money, paper trading or simulation can help you test your strategy in a risk-free environment. This allows you to fine-tune your approach and gain confidence.

4. Start Small

Once you feel comfortable with your strategy, start with a small amount of capital to manage risks while you build your experience in live trading conditions.

Conclusion

Forex trading can be a lucrative endeavor if approached with the right strategies and mindset. By utilizing effective trading strategies and maintaining discipline in execution, traders can navigate the complexities of the Forex market with confidence. Download our free PDF guide on Forex trading strategies to deepen your knowledge and enhance your trading skills.

Recent Comments